UAE E-INVOICING READINESS

Be Ready for E-Invoicing.

Fyient helps you align with the new UAE framework through verified ASP integration—validate invoice data, generate compliant XML, transmit securely, and stay audit-ready.

Verified ASP Integration

UAE Rule Validation

XML Generation & Delivery

Audit trail + support

What is UAE E-Invoicing?

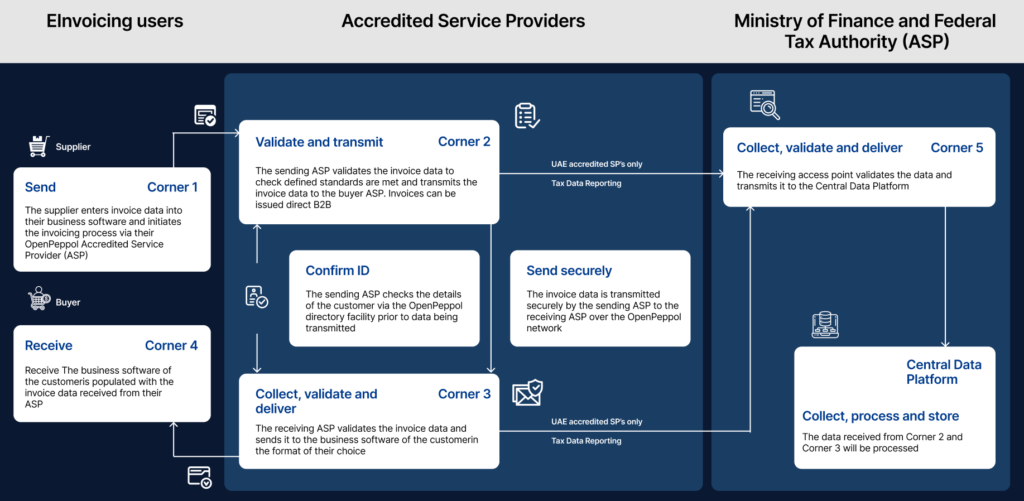

E-invoicing is the electronic exchange of invoice documents in a structured format that enables automatic processing. In the UAE model, invoices are validated and transmitted through accredited service providers and shared networks, supported by centralized reporting expectations.

Plan your compliance rollout with Fyient.

Book a readiness call to assess scope, risks, and the most practical integration path—before timelines compress.

UAE model explained (Simplified)

E-invoicing is the electronic exchange of invoice documents in a structured format that enables automatic processing. In the UAE model, invoices are validated and transmitted through accredited service providers and shared networks, supported by centralized reporting expectations.

Your ERP generates invoice data.

Your ERP creates the invoice with all key fields (buyer/seller, items, taxes, totals) captured in a consistent structure.

Invoice data is transformed to the required structured format.

The invoice data is mapped and converted into the UAE-required e-invoice format (such as structured XML) without changing your workflow.

The invoice is validated and transmitted through the compliant network path.

The invoice is validated against UAE compliance rules, then securely transmitted via the approved e-invoicing network route.

Buyer receives the invoice into their system in a usable format.

The buyer receives a machine-readable invoice that can be directly ingested into their ERP for faster processing and reconciliation.

Reporting and audit visibility are preserved through the model design.

Each step is tracked end-to-end, preserving delivery status, logs, and audit trails needed for compliance and internal reporting.

Timeline and readiness

For many organizations, the risk is not “compliance awareness”—it’s delayed readiness: integration, validation rules, governance, data quality, and change management.

- Appointing an accredited service provider is a key prerequisite

- Mandatory enforcement is phased

- Early readiness reduces disruption and avoids rushed cutovers

Segment /Category

Companies with Revenue > AED 50 M

Companies with Revenue < AED 50 M

Government Entitles

Appoint Accredited Service Provider(ASP)

31st July 2026

31st July 2026

31st July 2026

E-Invoicing Mandatory

1st January 2027

1st January 2027

1st January 2027

What changes internally (cross-functional impact)

Implementation sits at the intersection of operational finance, tax compliance, and technical delivery. Successful programs align ownership and decision-making early.

Finance

AR/AP workflow alignment, reconciliation visibility, dispute handling

Tax:

validation rules, reporting needs, audit readiness

IT/Systems:

integration build, security, data transformation, testing

Procurement/Sales:

onboarding workflows, master data discipline, commercial processes

Legal/Compliance:

governance and policy alignment

The Fyient approach

Fyient provides a structured program from advisory to post go-live—designed to reduce disruption and ensure audit-ready operations.

E-Invoicing Inquiry & Regulatory Advisory

Understand what UAE e-invoicing demands for your business, and clarify the exact compliance scope, timelines, and obligations before planning the build.

- Regulatory Compliance Analysis

- Current Systems Diagnostic

- Technical Regulatory Compliance Analysis.

Impact Assessment & Gap Analysis

Evaluate your current ERP/POS and invoice flow to identify data gaps, missing fields, risk areas, and what must change to meet the UAE model.

- System Evaluation.

- Data Mapping (PINT AE)

- Risk & Skill Analysis

Selection & Integration Strategy

Evaluate your current ERP/POS and invoice flow to identify data gaps, missing fields, risk areas, and what must change to meet the UAE model.

- Vendor Selection Support

- Solution Architecture

- Implementation Roadmap

Installation Testing & Go-Live

Build and connect the system end-to-end, run validation/testing cycles, and go live with a stable compliant flow across internal teams and stakeholders.

- System Integration.

- Validation & Testing

- Change Management

Intensifying Future Updates

Maintain compliance continuously with monitoring, reporting, and enhancements—scaling the setup across entities, regions, or higher invoice volumes.

- Operational Support

- Compliance Embedding

- Scalability Planning

Frequently Asked Questions

What is e-invoicing in the UAE?

E-invoicing is the process of issuing, validating, and storing invoices electronically in a structured format as per UAE government regulations. It is not just a PDF invoice — it involves machine-readable data submitted through approved systems.

Is e-invoicing mandatory in the UAE?

The UAE is moving toward mandatory e-invoicing under the Ministry of Finance’s digital transformation initiative. Businesses will be required to comply in phases, depending on regulatory timelines and turnover thresholds.

What is the purpose of e-invoicing?

E-invoicing is the process of issuing, validating, and storing invoices electronically in a structured format as per UAE government ra

The main objectives are:

Increased tax transparency

Reduction in fraud

Real-time or near real-time reporting

Improved compliance and audit readiness

Regulations. It is not just a PDF invoice — it involves machine-readable data submitted through approved systems.

What format is required for UAE e-invoices?

E-invoices must be generated in a structured electronic format (such as XML or JSON, depending on the framework). A simple PDF or scanned copy does not meet compliance requirements unless backed by structured data.

What is a Verified / Accredited ASP?

An Accredited Service Provider (ASP) is a government-approved intermediary authorized to connect your system to the UAE e-invoicing framework. Businesses must work with an approved ASP to transmit invoices securely and compliantly.

Plan your compliance rollout with Fyient.

Book a readiness call to assess scope, risks, and the most practical integration path—before timelines compress.

Add Your Heading Text Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!